According to Bloomberg News, IBM is scheduled to hold a general meeting of shareholders in Tampa, Florida on Tuesday, when shareholders will vote whether to pay CEO Ginni Rometty a salary of 33 million.

For any CEO, this is a huge sum of money, especially for Luo Ruilan. Understand that IBM's revenue fell for five consecutive years under her leadership and the shareholder return was less than 0.1%.

The fact is that this figure may have misrepresented her actual salary - 50% or more lower, because this figure does not include her stock options.

According to the valuation of Luo Ruilan's options held by the stock agent Institutional Shareholder Services, Luo Ruilan’s total revenue in 2016 may exceed 50 million US dollars. Bloomberg’s independent calculations also show that given the recent rise in IBM’s stock, Luo Ruilan’s current compensation is worth US$65 million, which is almost twice the company’s reported figure.

The gap between the company’s reported compensation and the actual income of the CEO reflects the inaccuracy of the valuation of stock options. This involves a complex, sometimes opaque, number game. By adjusting some assumptions, the rewards disclosed in the regulatory documents may be less than the actual figures. Although this practice is legal and fairly common, this time Luo Ruilan's example made some people very unhappy.

"Their valuations are very unusual," said John Core, an accounting professor at the MIT Sloan School of Management, who spoke about IBM's valuation of the Rolleilan option. "There must be some discretion, but this seems to be at the more extreme end."

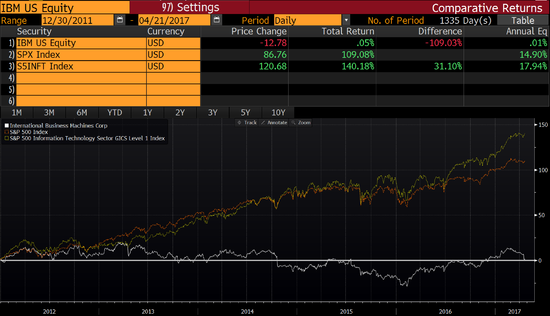

(Royal Blue's stock price movements under IBM)

An IBM spokesman, Ed Barbini, said that for more than a decade, New York company Armonk has been using the same method to evaluate option awards, and in line with the United States Accounting Accredited Principles (GAAP) and the Securities and Exchange Commission. The spokesperson said that Luo Ruilan and the director responsible for setting the salary are not commented. PricewaterhouseCoopers, who audited IBM's accounts, also declined to comment.

IBM is scheduled to hold a general meeting of shareholders in Tampa, Florida on April 25th at 10:00 AM.

High salary is considered a danger signal

In January 2016, IBM awarded Luo Ruilan 1.5 million stock options at a valuation of approximately US$12.1 million. Luo Ruilan’s normal salary at that time included salary, bonuses, and shares of approximately US$21 million. IBM did not disclose any assumptions about the valuation plan and rejected Bloomberg's request.

ISS believes that Luo Ruilan's stock option award is a dangerous signal. According to ISS calculations, this award is nearly 60% lower than the “fair value†of $29 million given by ISS. This gap ranked first in the Standard & Poor's 500 company that gave executives option awards last year. This option gift was an important reason why the ISS decision very rarely suggested that IBM shareholders vote to reject the bonus plan. IBM shareholders include Buffett’s Berkshire Hathaway and fund giants Vanguard Group and BlackRock.

Another rival stocks agency, Glass Lewis, also advised investors to vote against it, although it did not evaluate Luo Ruilan's options.

Although the "say on pay" system is only recommended, it is not binding. However, any approval below 70% not only makes the directors of the company very embarrassed, but also may lead to unnecessary review and censure to investors. Pioneer Group and BlackRock declined to say how they would vote, and Berkshire did not respond to requests for comment.

Black-Scholes

Of course, IBM's valuation method may be different from that of Bloomberg and ISS.

Both Bloomberg and ISS use the Black-Scholes model, which is a widely accepted option pricing method. Although IBM also uses this precaution, the compensation committee uses different option execution prices and grant methods to divide the options into parts. This process may use Monte Carlo methods and binomial lattices. . Many inputs such as volatility, dividend yield, and expected life of the securities will affect the fair value.

Thanks to the 21% rebound in IBM stock last year, Luo Ruilan’s salary package is currently worth US$65 million. This enabled her to earn more than her peers, Microsoft Nadella and HP Whitman, to rank among the top ten highest-paying CEOs in the United States.

Is her salary too high?

On the other hand, Luo Ruilan’s five years as head of office did not bring much return to IBM’s long-term shareholders. Since serving as IBM's CEO in January 2012, IBM has only returned 0.05%. The S&P 500 index doubled in the same period, and technology companies returned more on average.

“She is overpaid.†Ivan Feinseth of Tigress Financial Partners said bluntly. "She did not create value for shareholders in five years."

It is fair to say that Luo Ruilan served as chief executive officer when IBM, the century-long enterprise, was the shortest. It is not easy for her to try to lead the Blue Giant to transform from a shrinking business such as computers and operating system software to high-growth areas such as cloud computing and AI. Luo Ruilan also took over his predecessor’s commitment to allow IBM stocks to achieve a profit of US$20 per share in 2015. Analysts had predicted that she would be caught in a short-term stagnation due to repurchase and divestments, eventually giving IBM the cost of time and money.

Options Rewards

Although Luo Ruilan gave up her profit goal in 2014 on the grounds of transformation, she still failed to adjust the heading of the company's big ship. IBM’s report last week showed that the company’s revenue in the first quarter fell to a 15-year low. Analysts predict that sales will continue to shrink this year. The gross profit margin dropped to the lowest in ten years.

How IBM paid $12.1 million to Luo Ruilan remains a mystery. However, equity planners believe it may follow the standard processes of most companies.

The usual process is as follows: The board of directors sets a dollar price for the reward, and then causes the pay expert to reverse the introduction of the option structure with the lowest option for the single stock option. The lower the price of a single stock, the greater the number of shares. As a result, executives can obtain the maximum number of shares, and the reported salary figures can also satisfy shareholders and supervisory agencies.

However, the gap between the values ​​in IBM's case was such a big surprise. Barbara Baksa, executive director of the American Association of Stock Plan Professionals (NASPP), said: "There must be some judgment that has a great influence on the value of options. If you know this, you will understand this difference. secret."

Misrepresentation of low prices also contributes to the company’s profitability. It lowers the cost of stock compensation and can increase the tax deductions that companies receive when exercising options. The larger deductions will in turn increase the earnings per share, which is an important financial indicator IBM has repeatedly emphasized over the years.

Timely reward

In any case, this option award is quite timely for Luo Ruilan. IBM chose to grant options on January 26, 2016, when the stock fell to its lowest point in five years, showing the board's "firm confidence" in Luo Ruilan's leadership.

Shortly thereafter, the stock of IBM ushered in a rebound. Although the value of the option fluctuates between 5% and 25%, it is in-the-money in less than six months.

Vahan Janjigian, principal investor of the asset management company Greenwich Wealth Management, believes that regardless of the actual value of the compensation package, Luo Ruilan has already earned a lot.

"I don't think it should be," said Janjigian. His company holds IBM shares and Janjigian declined to say how it will vote. "The stock has been doing well since bottoming, but I don't think she should be rewarded for this." (Sun Wenwen)

yucheng county huibang electric technology ltd , https://www.hbspeaker.com