Thanks to the overall recovery of the global economy and the recovery of the terminal lighting market, the overall revenue of the LED industry in the third quarter of this year has improved compared with the same period last year. However, due to the downward trend in the price of downstream application market and the intensification of competition in the industry, the performance of LED listed companies in the third quarter can be described as several happy.

From the overall situation, the growth rate of A-shares in the third quarter after the elimination of finance was 11.9%, which was a significant increase of 5 percentage points compared with 6.6% in the interim report. Among them, the main board companies experienced a super-seasonal rebound, and the growth of the GEM was stable, but small and medium-sized. The board is weak. In the LED main board listed companies, including Sanan Optoelectronics (600703.SH), Tongfang (600100.SH), Lianchuang Optoelectronics (600363.SH), Silan Micro (600460.SH) and other three quarters of net profit have appeared larger The increase in magnitude.

In the small and medium-sized board and the GEM, the number of mainstream LED listed companies whose net profit increased in the third quarter was obviously high, especially Jufei Optoelectronics (300303.SZ), Ruifeng Optoelectronics (300241.SZ) and Zhouming Technology (300232. SZ), Liard (300296.SZ) and other LED companies involved in the middle and lower reaches, the demand for LED backlight market is strong and the LED small-pitch TV market broke out, and the performance in the third quarter has grown rapidly.

Despite this, in the long run, the main engine of the LED industry is still LED lighting.

“In the first half of this year, the newly-planned investment in the domestic LED industry reached 37 billion yuan, of which the newly-planned investment in LED downstream lighting applications accounted for 70%, while the upstream sapphire substrate and epitaxial chip investment accounted for less than 10%.†Dr. Zhang Xiaofei, director of the High-tech LED Industry Research Institute, said that the LED industry is currently in a period of rapid development, and the number of industry entrants is increasing. It is a general trend for industrial investment booms to flow downstream.

However, from the income of LED listed companies involved in the middle and lower reaches in the first three quarters, the shift of investment focus to the middle and lower reaches has not brought considerable profit returns to many investors. On the contrary, gross profit margins continue to decline, allowing upstream chip makers and more. Many downstream LED lighting companies are caught in the situation of “increasing revenue and not increasing profitsâ€.

Chip prices are stabilizing demand

"From the perspective of the company's chip sales in the third quarter of this year, the demand growth of the entire chip market is still strong. Last year, we only had one plant put into production, and this year, both production workshops are full of production status." Liu Gang, executive deputy general manager of Tongfang shares, accepted "High-tech LED" reporter said in an interview that the cumulative sales of Tongfang shares in the first three quarters has exceeded 300 million yuan. It is expected that the sales performance of chip business in 2013 will exceed 400 million yuan.

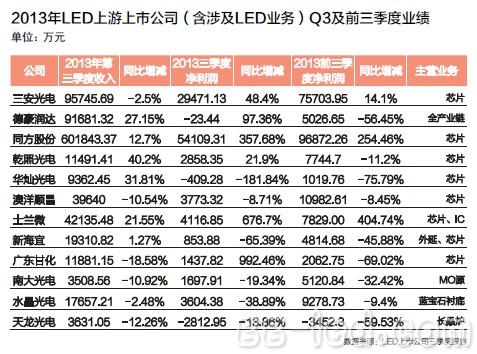

In fact, the revenue of mainstream LED chip manufacturers in the third quarter, except for Sanan Optoelectronics, which fell slightly by 2.5% year-on-year, Dehao Runda (002005.SZ), Ganzhao Optoelectronics (300102.SZ) and Huacan Optoelectronics (300323.SZ) There has been a rapid increase in growth, and the net profit of several companies has changed from the general decline in the data.

In addition to Huacan Optoelectronics and Aoyang Shunchang (002245. SZ), due to the impact of new projects, the performance has declined. Sanan Optoelectronics, Dehao Runda and Ganzhao Optoelectronics increased their net profit in the third quarter. 48.4%, 97.36% and 21.9%.

Although from the financial report data, the profitability of several chip-listed companies has improved, this does not mean that the upstream epitaxial chip industry has already stepped out of the dilemma of increasing profits.

“The large increase in net profit in the third quarter was actually affected by comprehensive factors such as small household appliances and mid-stream and downstream businesses. Several major chip manufacturers are expanding their production capacity, and upstream competition is still fierce.â€

Dehao Runda’s secretary-general Deng Fei told reporters that although the situation of mainstream chip manufacturers has been greatly improved compared with the same period of last year, the decline in chip prices has also narrowed, but it still needs a period of time to get rid of the situation of increasing profits. Time.

"In the second quarter of this year, the demand for chips in the market is strong. The price of our chip products has increased by about 10% compared with the beginning of the year. The price of chips in the third quarter has been basically flat. The MOCVD equipment is also in full production, but the market situation in the fourth quarter. There is uncertainty." Liu Gang said.

Generally speaking, the second and third quarters are the peak season of the chip market. The customer orders are sufficient and the price fluctuations will be relatively stable. However, it is worth noting that after entering the off-season in the fourth quarter, the market demand has dropped sharply, and the chip manufacturers have cleared the backlog at the end of the year. The chip price may show a certain degree of decline.

Hua Can Optoelectronics Secretary of the Board of Directors Ye Aimin expressed concern about this situation. “In the first half of the year, due to the rapid decline in chip gross margin, the company’s revenue and profit will be greatly affected by this. In the fourth quarter, the upstream chip industry may face irrational competition risks between large manufacturers. The survival of second-tier manufacturers lacking market base will be more The worse it is."

In order to improve the increasingly severe living conditions, some second-tier chip manufacturers began to improve their overall supporting capabilities. For example, Huacan Optoelectronics recently announced that its second-phase project has expanded its production and sales volume with relatively optimistic red and yellow light chips. Maanshan Yuanrong Optoelectronics also indicated that it has expanded production. The intention of the red-yellow chip, while the dry photo-electricity is bidding for Yangzhou Longyao Optoelectronics, expanding the blue-green optical chip business to supplement the lighting "short board".

Packaging companies have a good harvest and gradually enter the peak season

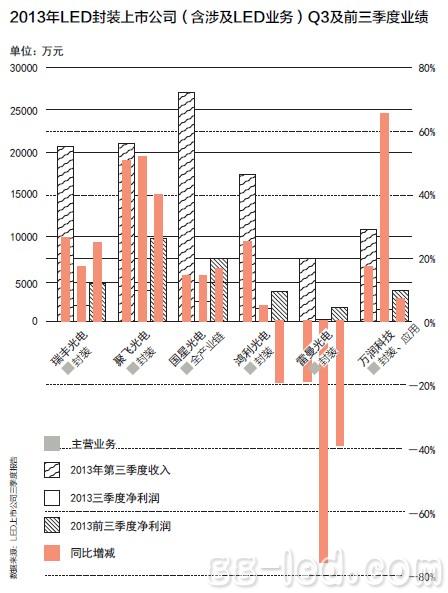

For the packaging manufacturers, the LED lighting market broke out in the second quarter and the rapid replacement of Taiwanese manufacturers by the mainland backlight packaging factory, which made it a good harvest in the third quarter, and changed the general performance of the mid-year report.

In particular, Jufei Optoelectronics (300303.SZ) and Ruifeng Optoelectronics (300241.SZ) benefited from the surge in demand in the backlight market. The performance in the first half of the year has been all the same. The net profit of the first three quarters was 94.622 million yuan and 45.431 million yuan respectively. Compared with the previous period, it maintained a high growth of 40.46% and 25.42% respectively, leading the LED packaging industry.

In addition, Hongli Optoelectronics (300219.SZ), Guoxing Optoelectronics (002449.SZ), Wanrun Technology (002654.SZ) and Zhaochi (002429.SZ) in the LED packaging field increased their net profit in the third quarter. 5.33%, 14.94%, 65.63% and 10%, only Lehman Optoelectronics (300162.SZ) has not been able to turn a profit, its third quarter operating income fell 18.7% year-on-year, while net profit was only 1,625,200 yuan, compared with the previous period A sharp drop of 76.14%.

"In addition to the main backlighting packaging factory, the remaining LED packaging listed companies' net profit growth mainly comes from the outbreak of orders in the LED lighting market in the second quarter. The general packaging company's receipt period is about 60 days, so the third quarter The performance report is relatively beautiful.†A senior executive of the LED packaging factory told reporters that in April and May, the orders of the packaging factory were almost in July, but after entering July, the packaging factories generally received large orders.

However, Hongli Optoelectronics Secretary-General Deng Shou-ti said that according to the market law, the general LED packaging season is at the beginning and the end of the year. Now, after entering the fourth quarter, the orders of the packaging factories are gradually increasing. But this does not mean that all packaging companies will have a good life, whether the overall situation of the packaging industry can improve, still depends on the popularity of the downstream lighting market next year.

In addition, according to relevant statistics, the penetration rate of LED-backlit LCD TVs reached 90% in 2013, which indicates that the large-size backlight market is about to enter the saturation stage. Although the lighting application market has broad prospects, the LED backlight can be replaced to improve the overall situation, but the market situation of the packaging industry still has hidden risks.

Especially in recent years, including LED manufacturers such as Sanan Optoelectronics and Dehao Runda, the vertical integration of the middle and lower reaches has been continuously increased, and the LED packaging technology content is not high. The downstream LED application enterprises are gradually extending to the middle reaches and are involved in LED packaging enterprises. More and more, resulting in fierce competition in the entire LED packaging field, gross margins fell sharply, and many packaging manufacturers are invaluable.

"According to the current situation, after 3-5 years, LED packaging companies will face a very unfavorable situation. If there is no upstream and downstream layout and integration, enterprises will definitely have big problems." Ruifeng Optoelectronics Chairman Gong Weibin has already sensed the crisis situation of the packaging industry in the next three years. The rise of new technologies such as packaging technology, EMC packaging, flip chip packaging and flip chip will also bring huge potential risks to many LED packaging companies in China.

Kehei not only sells its products globally but communicates regularly with customers throughout the world insuring that the products continue to meet or exceed expectations. And customer references are available upon request. The shell of LED Downlights adopt integrated design, it optimize efficiency of heat dissipation. PC shade high transmittance ,weather resistance. High cooler rendering index luminous efficiency with soft light output. Low power consumption.Lower heating during operation. Lumen decay: 3 within 1000 hours. Then Lumens be stable.

*Related Products:interior lighting,high efficiency led,down light.

Smd Downlights,5W Smd Downlights,15W Smd Downlights,3W Smd Downlights

SHENZHEN KEHEI LIGHTING TECHNOLOGY CO.LTD , https://www.keheiled.com