Summarized in one sentence: According to market IDC survey, the global smartphone market in the second quarter statistics shows that mobile phone shipments in the first half of this year were 343.3 million units, a year-on-year increase of only 0.26%, and the mobile phone market was weak. Samsung s7 is the flagship hotspot for this year, and its hegemony position; Apple's innovation is insufficient, and it remains in a downturn; OPPO and vivo develop offline retail store sales, expand low-end urban retail stores; Huawei frequently patents and actively expands overseas markets. ..

"The smartphone market is saturated", which is a remark that has been repeatedly emphasized by people in the mobile phone industry in the past year.

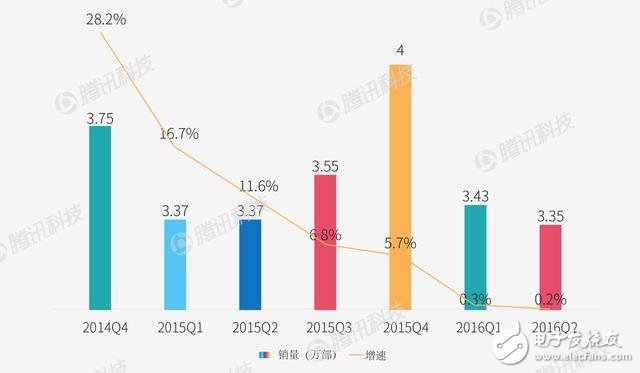

Sure enough, market research firm IDC's latest global smartphone report released in the second quarter showed that global smartphone shipments in the last quarter were 343.3 million units, a year-on-year increase of only 0.26%. This is the second consecutive quarter of global smartphone sales. The speed dropped to less than 1%.

The global smartphone market is close to saturation

From the latest data, the global smartphone landscape has changed a lot: Samsung still maintains its dominance, and the second apple is gradually getting tired, in the third place, and for a long time to surpass Xiaomi. Proud Huawei, had to be wary of the two domestic little brothers OPPO and vivo, as for the millet that once created myth, has been assigned to "other".

Samsung's dominance is stable and the iPhone is not strong.

Two days before IDC released the latest smartphone report, Apple and Samsung also released the latest financial reports, but the results were both sad and happy.

In the second quarter, Apple sold a total of 40.399 million iPhones. Although shipments exceeded expectations, it still fell 15% from the same period of last year. This is the iPhone's two consecutive quarters of decline in shipments, and directly caused Apple's revenue and net profit. Continue to languish.

Samsung has already gone out of the past year's downturn, net profit increased by 1.65% year-on-year, exceeding analysts' expectations. Mobile phone sales also increased by 5.5% to 77 million units, which is more than the second apple and third place Huawei. There is more to sum.

The gap between the two is constantly widening

Samsung's latest flagship model, the Galaxy S7, played a leading role in the company's gorgeous turn. Due to the lack of products in the market, the Galaxy S7 unexpectedly became an explosion product this year. It not only has a difference between the curved screen and other mobile phones, but also has practical functions such as waterproof and dustproof.

The market expects Samsung Electronics Galaxy S7 to sell 10 million units in the first quarter, while shipments in the second quarter were 16 million units, and the more expensive curved screens sold more than the flat version.

In addition, Samsung Electronics' more streamlined production line helped the company reduce costs in order to survive in today's more competitive environment. In the past, Samsung always liked to launch as many mobile phone products as possible to test which ones would be popular with consumers. However, Samsung's strategy in smartphones is different from that of Apple. When Apple is looking for new growth in the category of sales decline and expansion, Samsung Electronics is cutting product types.

Daniel Kim, an analyst at investment bank Macquarie, said: "Obviously, Samsung Electronics has learned a lesson in the past two years, and they have made a big improvement in cost control and product mix. ""

In contrast, Apple is not as attractive to users as it used to be, mainly because of its lack of innovation, and even uncharacteristically launched iPhone SE with smaller screen and cheaper price, which directly led to the decline in iPhone revenue exceeding sales. The decline.

Looking at the upcoming iPhone 7 in September this year, according to the information currently exposed, this latest Apple flagship machine still has no exciting new features, perhaps the iPhone's downturn will continue for some time.

The rise of OPPO and vivo is amazing

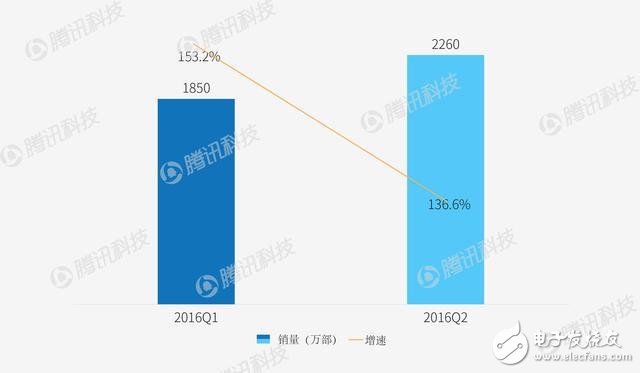

In IDC's report, two companies are quite eye-catching: BBK's OPPO and vivo, after being among the top five in the world, the two mobile phone manufacturers maintained a staggering growth of 136.6% and 80.2% respectively.

OPPO's sales trend after entering the top five in the world

Vivo enters the world's top five sales charts

The reason behind the success of OPPO and vivo is very simple – give up e-commerce. Unlike Xiaomi's online sales, OPPO and vivo avoid online sales, focusing on offline retail sales, especially in low-end cities, and often sign exclusive distribution agreements with vendors. The two companies seem to be very clear that the potential of low-level cities has not been fully tapped, and the e-commerce ecology of these places has not yet been perfected, including the construction of network infrastructure and logistics systems, and the development of online shopping awareness.

According to data disclosed by the media, these efforts have enabled OPPO to establish a network of more than 200,000 retail stores throughout the Chinese market. These retail stores are selling smartphones designed for young, budget-conscious urban consumers. According to data provided by market analyst firm Canalys, the average selling price of OPPO mobile phones is 270 US dollars, which is the price that meets the needs of second and third tier cities and county towns.

Jindi, research manager at IDC China, said that in 2013, many smartphone companies began experimenting with e-commerce, but OPPO believes that the opportunity for smartphones still lies in offline retail stores. The reason is that the core customers of smartphones are still in multiple regions where logistics is not developed. Retail stores can make it easier for consumers to try OPPO phones and provide consumers with a lot of after-sales services.

Of course, one of the big challenges for OPPO and vivo is how to win the favor of consumers in mainstream urban markets such as Beijing and Shanghai. The two companies need to increase their brand influence among high-end consumers to achieve greater growth. But this is no easy task.

The smart phone market in China's first-tier cities is dominated by high-end brands such as Apple and Huawei. Therefore, it will be very difficult to squeeze into these high-end markets, which is more difficult than selling low-end smartphones to consumers who want to save money. Much larger, because users there are less willing to try non-branded phones.

Huawei's frequent patent warfare does not take Xiaomi's "slow down road"

Finally, let's take a look at Huawei, the big brother of China. This week, Huawei announced the performance of smartphones in the first half of 2016. Huawei's consumer BG CEO Yu Chengdong said that Huawei's mobile phone shipments in the first half of the year were 60.56 million units, up 25% year-on-year; sales revenue was 77.4 billion yuan, up 41% year-on-year. “Huawei’s global smartphone market share last year was 9.9%, and it has reached 11.4% in the first half of this year. China’s market share still ranks first with 18.6%.†Yu Chengdong said.

The data looks very glamorous, but Huawei's crisis awareness is also very strong. In the past one or two months, Huawei has frequently launched patent wars in the field of mobile phones and communications, and has had patent disputes with Samsung, Nokia, and T-Mobile, the fourth largest operator in the United States.

Due to the lack of patent accumulation, Xiaomi's international strategy is more conservative, and it has encountered patent challenges in areas such as India. This has curbed the expansion of Xiaomi's mobile phone to a certain extent, and Huawei is very aware of this.

In the case of the increasingly saturated domestic smartphone market, Huawei has to focus on overseas markets. Yu Chengdong also expressed his position many times, hoping to surpass Apple and Samsung in three to five years, so he frequently launched patent wars, perhaps Huawei. Prepare a heavy weapon, establish a strong technical image, drive its own brand to spread on a global scale, and form a solid first camp.

YUEQING WEIMAI ELECTRONICS CO.,LTD , https://www.wmconnector.com