For the four major communication companies Huawei, Ericsson, Nokia and ZTE, 2016 is a year of change and a few happy ones:

1. On January 14, Nokia, which has controlled more than 80% of Alcatel-Lucent's equity, announced that the acquisition was basically completed and officially began joint operations. On November 2, Nokia announced the official completion of the acquisition of Alcatel-Lucent's 100% equity transaction. After the merger with Siemens Communications in 2007 and the acquisition of Motorola Wireless in 2011, it reached the end of the fate of the third telecom giant.

2. On March 7, the US Department of Commerce's Bureau of Industry and Security (BIS) announced on its official website that it decided to implement export restrictions on ZTE. On April 5th, Shi Lirong, who has been CEO since 2010, resigned as CEO. The former CTO Zhao Xianming became the company's CEO and chairman. In March 2017, ZTE announced that it had agreed to pay a fine of US$892 million to reach a settlement with the US government.

3. On July 25th, due to poor performance, Hans Vestberg, who has been in charge of Ericsson for six years, stepped down as president, CEO and board member. On October 26, Ericsson announced the appointment of Borje Ekholm as the company's new president and CEO.

4. On November 17, Huawei's Polar Code scheme defeated Qualcomm's LDPC and France's main Turbo2.0 in the 3GPP short-code solution discussion of the 3GPP conference, becoming the 5G control channel eMBB scene coding scheme. Domestic public opinion called it the rise of China's voice in the global communications field.

The above-mentioned representative events that occurred in the four major manufacturers reflected the ups and downs of the communications equipment industry caused by increased market competition. Especially after Nokia’s acquisition of Alcatel-Lucent, the concentration of the communications equipment industry further increased and directly led to Changes in the pattern of four communication vendors, Huawei, Ericsson, Nokia and ZTE.

Therefore, the author interprets the 2016 financial reports of Huawei, Ericsson, Nokia and ZTE, which are aimed at understanding the changes in the strength of communication equipment market participants through the analysis of financial data, and discovering the changes in the competitive landscape of the communications equipment industry. Going.

Before the interpretation, it should be noted that the four communication companies are mainly in different countries, and the financial data used in the financial report data are different: Huawei and ZTE adopt RMB, Ericsson adopts Swedish Krona, Nokia adopts Euro, so in order to facilitate horizontal comparison, this article will The financial data of the home is uniformly converted into US dollars for accounting. At the same time, since Huawei has converted its financial data into the US dollar amount according to the year-end book-entry exchange rate on December 31, 2016, it is also converted into the financial data of the other three companies. Use the year-end book-entry exchange rate for conversion to avoid confusion. In addition, as ZTE is listed in Shenzhen and Hong Kong, the data reported by ZTE in this paper mainly comes from the data under the Hong Kong Financial Reporting Standards that are similar to the international GAAP, in line with the other three manufacturers.

First, the four major communication manufacturers in 2016 revenue rankings and changes in the pattern

According to the financial report data, the overall revenue changes and rankings of the four major communication vendors in 2015~2016 are as follows:

It can be seen that in the company's overall business income, the performance and ranking of the four major communication vendors in 2016 is not much changed compared to 2015:

1. Leading Huawei Huawei continued to open the revenue gap of 24% and the income gap of the latter three. Considering the impact of exchange rate, Huawei is the only company to achieve revenue growth in 2016, and its revenue exceeds 70 billion US dollars. And more than the sum of the last three, equivalent to 3 times that of Nokia or Ericsson and 5 times that of ZTE.

2. After the merger of the two companies by the acquisition of Alcatel-Lucent, Nokia surpassed Ericsson to rank second, basically achieving its goal of competing against the opponents in terms of revenue through mergers and acquisitions, but the two are quite similar. Whether the company can achieve 1+1 after the merger between companies is still full of challenges for Nokia's management.

3. Considering the impact of exchange rate, Ericsson is the biggest decline in income among the four households. Under the double attack of external market changes and internal personnel changes, the lack of growth has always been a difficult situation that Ericsson is difficult to crack.

4. ZTE, which is at the end of the team, although its growth momentum has been obvious in the past three or four years, its operating income has been hovering around 15 billion US dollars. It shows that its existing business structure is not enough to support the company’s revenue breakthrough, unless it is like Nokia has taken an outward expansion of mergers and acquisitions, otherwise it will be difficult to turn over under the existing market structure.

The overall business revenue comparison can reflect the size and strength gap of the four major communication vendors to a certain extent. However, due to the differences in the strategic orientation of each company, the business layout is different. It is difficult to directly reflect the overall business income in the same market. Coordinating the competitive strength of the business, so we need to make further subdivisions.

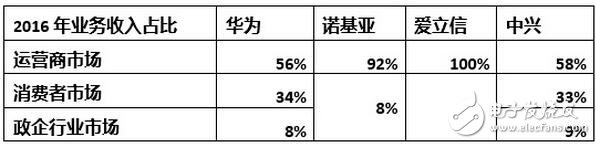

From the business income structure of the four major communication vendors shown in the above table, Ericsson's business composition is the single most, almost all concentrated in the operator business field; Nokia has entered the consumer market through Nokia Technology and acquired IP and application products. The company's business, but the carrier-based network business still accounts for more than 90% of the company's revenue; Huawei and ZTE expand their business, corporate and consumer businesses through diversification strategies. In particular, the mobile phone-based consumer business has developed rapidly in the past two years, but in terms of revenue structure, its carrier business still accounts for nearly 60% of its overall business revenue, so these four major communication vendors The highly competitive coincidence market is still mainly concentrated in the operator business area.

In the segmented carrier business area, the business revenue comparison of the four major communication vendors is shown in the following figure:

It can be seen that Huawei, which has a market share advantage in China and Asia Pacific, benefited from China's 4G network construction and increased investment in infrastructure construction in India and Thailand. Its total revenue in 2016 has further increased; Ericsson and Nokia are affected by the United States and Japan. The weak market demand led to a decline in revenue; Huawei's dominant market position in the carrier business area was further strengthened. Its revenue share rose from 35% in 2015 to 43%, accounting for almost half of the market and the other half. Jiangshan was divided by Ericsson and Nokia. The remaining left to ZTE is only about 9% of the gap and more than $80 billion in volume. Under the attack of one and two outside, the pattern is more difficult.

A buzzer or beeper is an audio signalling device, which may be mechanical, electromechanical, or piezoelectric (piezo for short). Typical uses of buzzers and beeper include alarm devices, timers, and confirmation of user input such as a mouse click or keystroke.

Piezo Buzzer,Dc Electro Magnetic Buzzer,Buzzer Acoustic Components,Piezo Buzzer For Thermometer

Jiangsu Huawha Electronices Co.,Ltd , https://www.hnbuzzer.com