With the global solar market growing by as much as 139% in 2010, battery makers are optimistic about 2011 and have started aggressive expansion plans. According to the latest quarter report of Solarbuzz PVEquipmentQuarterly, the total revenue of related equipment manufacturers in 2011 is expected to reach 15.2 billion US dollars, an increase of 41%.

With the global solar market growing by as much as 139% in 2010, battery makers are optimistic about 2011 and have started aggressive expansion plans. According to the latest quarter report of Solarbuzz PVEquipmentQuarterly, the total revenue of related equipment manufacturers in 2011 is expected to reach 15.2 billion US dollars, an increase of 41%. In 2011, the annual growth of silicon-based equipment capital expenditure (including silicon ingots, wafers, cells and modules) is expected to reach 31%, while the increase in film equipment capital expenditures will reach 71%. Among them, the investment growth based on amorphous silicon thin film and CIGS technology is the fastest, accounting for 78% of the planned thin film technology market for expansion.

The first-line manufacturers who have expanded their production scale and scale quickly are the crystalline silicon manufacturers in mainland China, Taiwan's battery manufacturer FirstSolar and the leading manufacturer of thin films. According to the latest production target at the end of the current year, the following manufacturers' capacity plans are as follows: JASolar3GW, TrinaSolar1.9GW, NeoSolarPower1.8GW, and JinkoSolar1.5GW. Taking 2010 as an example, the global revenue of new crystalline silicon battery equipment is US$3.6 billion, while the proportion of Chinese mainland and Taiwanese manufacturers is 82%.

In addition, thin-film solar technology ushered in a new wave of investment. During the period from the first quarter of 2011 to the first quarter of 2012, there are up to 65 expansion plans for thin-film batteries, and the total capacity of the film manufacturers is expected to increase by 70% to 4.8 GW.

Solarbuzz senior analyst Finlay Colville said: "The equipment supply chain has benefited from new investments in solar plants in 2011. The first quarter's major equipment manufacturers, such as AppliedMaterials, Centrotherm, GTSolar and MeyerBurger, have an outstanding order amount of more than US$1 billion. They Therefore, increase shipments to meet the needs of first-tier manufacturers, while second-tier silicon and thin-film battery manufacturers will give more orders to those new equipment suppliers.

The rate of increase in production capacity is consistent with the first-line battery manufacturer's shipment plan. The target annual growth rate is 55%. However, with the reduction of electricity price subsidy policies in major European markets, the growth in market demand in 2011 is expected to be only 12%. This imbalance between supply and demand will allow battery manufacturers to adjust their expansion plans in the second half of 2011, which will have a certain impact on the equipment supply chain. At the same time, since the delivery cycle of manufacturing equipment is generally 3-6 months, it can be predicted that these changes will make the market even harder in 2012.

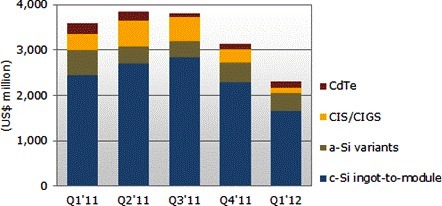

Q1'11~Q1'12 solar energy equipment expenditure by technology (unit: million US dollars) ╱Source:SolarbuzzPVEquipmentQuarterly

Equipment Expenditure Enters a Downturn in Advance In the first quarter of 2011, solar equipment expenditure innovation reached US$3.7 billion, and it is estimated that the second quarter will be the highest point of the current round of solar equipment spending cycles. As solar energy companies adjust their expansion plans in response to the decline in the market in the second half of the year, capital expenditures for solar equipment will decline sharply in the fourth quarter of 2011, and new orders for major equipment manufacturers from first-tier battery makers will gradually decrease.

However, the development of an efficient product line has provided new opportunities for suppliers of next-generation manufacturing equipment. Q-Cells recently announced that it will conduct a front-and-rear-side upgrade of its 1.1 GW battery line in the second half of 2011, reflecting the trend of product line upgrades. By the first quarter of 2012, various high-efficiency crystalline silicon cell lines will account for 35% of the production capacity of crystalline silicon cells. The application of new technologies will promote the application of new types of equipment, such as the ion implantation equipment of Varian Semiconductor Equipment Associates, a market leader in semiconductor equipment.

Due to the shipment of open orders in the first half of 2011, the number of equipment manufacturers in the first quarter of 2011 will be very high. However, the leading indicator is still new orders. Manufacturers will revisit the 2012 expansion plan according to market conditions. The manufacturers who invest in thin film technology will see the success of the new plant in 2011 and 2012 to see the next stage of investment. However, there are still many investors who are highly interested in the solar industry. It seems that they are still willing to invest in the solar energy industry.

Professional SMD LED Spot Light manufacturer is located in China. YiMing Lighting Technology could provide very high quality SMD LED Spot Light at very competitive prices. Want more about SMD LED Spot Light or LED replacement lights, please contact us.

SMD LED Spot Light

SMD LED Spot Light , Led Bulb Spotlight, LED Light, LED Lighting

Ningbo YiMing Lighting Technology Co., Ltd. , http://www.yimingtech.com